Click to read

Pluto: Empowering

local areas with private real

estate debt

Click to read

The roundtable

report

Click to read

CBRE IM: The need for a place-based approach to affordable housing

Catriona Buckley, senior director, client solutions, CBRE Investment Management

Andrew Davey, head of liability aware strategies & affordable housing, CBRE Investment Management

Justin Faiz, co-founder & partner, Pluto Finance

George Graham, director, South Yorkshire Pensions Authority

Jason Holland, editor, Room151

Ashley Manning-Brown, head of UK investor solutions, Pluto Finance

Mike O’Donnell, non-executive director, independent (Chair)

Christopher Osborne, senior portfolio manager private markets, London CIV

James Sivyer, vice president, private

markets, Redington

Jo Thistlewood, pension fund manager,

Isle of Wight Council

Matthew Trebilcock, head of pensions, Gloucestershire Pension Fund

Against a backdrop of economic uncertainty, real estate – when structured correctly – can provide sustainable, risk adjusted returns that act as an inflationary hedge.

What opportunities exist in the living and wider property spaces? How can these strategies achieve place-based impact? And what are the challenges and ways for the LGPS to invest in this asset class?

This roundtable explored where participants are currently with real estate, and found that while there are plenty of opportunities, there are no one-size-fits-all solutions and instead a variety of different paths to success in this ‘massive’ asset class.

Real estate investing

for the LGPS Roundtable

Justin Faiz, co-founder & partner, Pluto Finance

“Specialising in residential is massive – it is not a niche asset class. But we also don’t have enough of it. That’s an interesting conundrum.”

So even if the industry heroically manages to deliver again, it’s not going to scratch the surface of the cumulative shortfall. And this applies throughout the UK.

We can’t do anything about many of the reasons for the shortfall, but one thing we can change is that there is a systematic lack of availability for financing for house builders.

Justin Faiz, co-founder & partner, Pluto Finance: We are a UK-only real estate private credit platform, and we’ve been doing it since 2011. We’ve funded the delivery of about 10,000 houses throughout the country in residential construction projects. The average value of one of our properties is £300k. We think that’s affordable, with a lowercase ‘a’, to real local owner occupiers and local renters, and it’s the kind of housing the UK is tremendously short of.

Residential property is today worth about £8tn – about eight times the size of corporate commercial and commercial real estate and more than the sum of total market cap plus issuance of corporate bonds and gilts.

It is not a niche asset class; specialising in residential is massive. But we also don’t have enough of it. That’s an interesting conundrum. We are in the middle of a housing crisis that successive governments of any flavour have failed to fix, and it only gets worse.

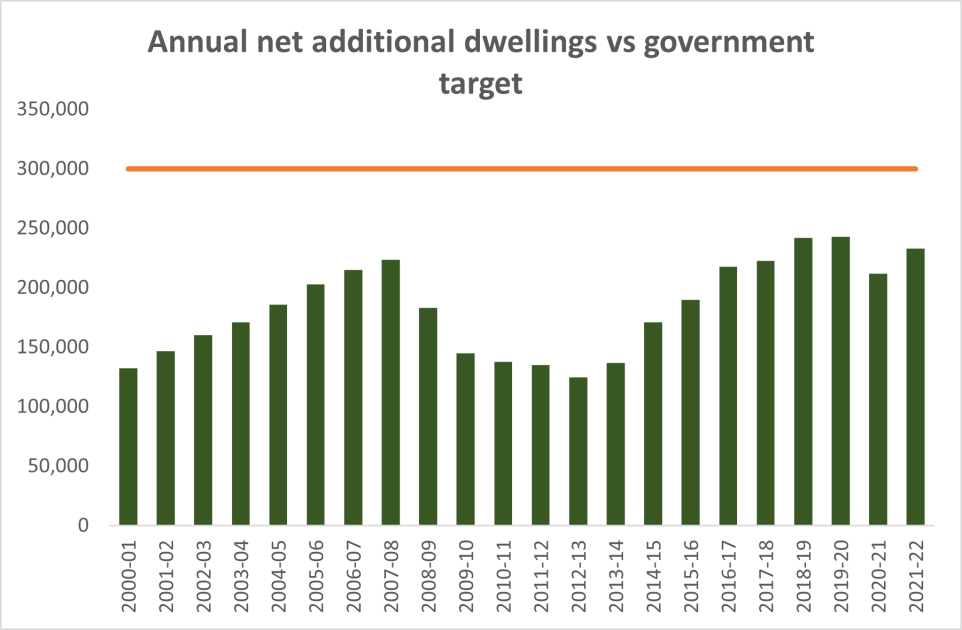

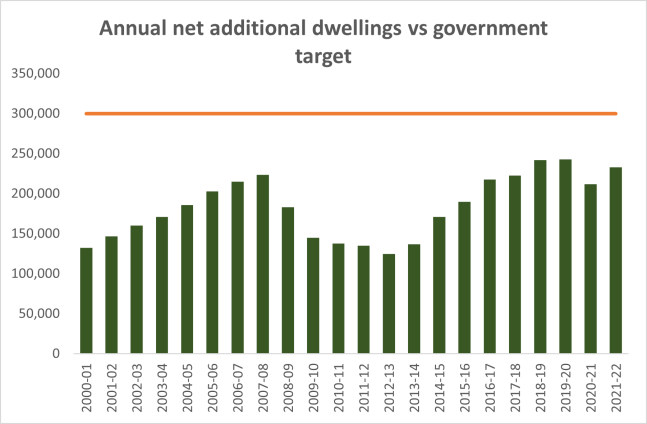

The current government needs to deliver about 300,000 units a year. At its pre-Covid peak, 220,000 units were delivered a year, so that’s still an 80,000 shortfall. Because of Covid, and with the gilts crisis and the volatility in interest rates, we are going to see a decline.

The housing crisis means headlines of high prices and rents. But it is also a societal effect that impacts people’s quality of life. People are living in substandard housing that’s often unsafe or unsanitary. Others are tolerating a commute that takes a chunk out of their work/life balance. Young adults are living with their parents later in life.

If you accumulate the total shortfall since around 2012, we’ve under delivered about 500,000 units.

Mike O'Donnell chaired the roundtable

If you’re a high street bank and you want to lend to fund a house builder, for a loan of any size, you need seven times as much tier one or tier two capital compared to a residential mortgage of the same size, and the returns are not seven times greater. So guess where banks want to lend? House builders and particularly SME developers have been starved for financing. We can do something to correct this.

There are a number of ways to access residential in the UK. We specialise on the equity side, and when we fund house builders, we’re funding at about 65% loan to value so that means there’s a 35%

headroom for the property prices, which is well sized to withstand any large property price correction. Borrowers are paying for that whole loan, and the margin is about 5-5.5%.

We like residential because there’s multiple exit options: you can build a scheme, you can lease it, you can refinance, or you can sell it to an institutional investor. That positions it well versus other asset classes with singular exits.

The other advantage, especially construction funding, is that the debt self regulates. At the end of two or three years the loan naturally repays.

Funding house builders is also inherently strong for ESG. Not only is the delivery of this affordable housing stock great for UK society, most of the funding can be on brownfield sites. We’ve chosen to do 95% of our funding on brownfield. It’s great for urban regeneration and for preserving green spaces.

Andrew Davey, head of liability aware strategies & affordable housing, CBRE Investment Management: The current UK affordability and residential crisis comes down to both demand and supply. There’s the more acute side to demand, with population rising, but the type of demographics is also changing. Households are becoming more disparate and there's more separation around what the target demographics in specific areas across the nation are actually looking for.

The supply side is also multi-layered. It’s not just the number of homes that are available, but also the suitability of housing. A small portion of the whole residential market is acceptable residential housing.

We want to narrow down into the local characteristics. Typically, we target the lowest 40% of deprived areas within the UK. However, that doesn't mean to say that an affluent area wouldn't be a focus for our investment because by definition it would be unaffordable to a number of the people living there. An affluent area may mean those longer waiting lists because people can’t gain access to the actual rental stock in those areas. But it also may mean that affordable ownership isn’t open to a number of the local population.

“We want to provide good quality, fit for purpose, future proof housing which is suitable for the local population and the incomes that they derive from local jobs.”

Andrew Davey, head of liability aware strategies & affordable housing, CBRE Investment Management

We haven’t got enough supply, and we probably haven’t got enough of the right supply. For us, that means building more houses and more of the right houses, led in an institutional framework making sure that we can influence what we are building.

At CBRE IM we’ve narrowed down into what we think is the most advantageous sub sector in residential, affordable housing. That’s where we can execute, and investors can achieve their financial, societal and wider impact goals. When we speak about affordable there are multiple layers within that. We typically target based upon regulated rent, which is basically benefit recipients.

We also target what we call the ‘squeezed middle’ in our other affordable bucket. We recognise that within London, 65%+ of an individual’s take home pay is made up of property costs or rent. That’s far too much, especially in the context of a cost-of-living crisis. We’re passionate about bringing that to a level which is sustainable going forward. Within London, for instance, we’re focusing on bringing that down to around 35 to 40% of an individual’s pay.

We recognise that renting isn’t the only equity solution in terms of investment. We provide an affordable ownership proposition recognising that a number of different people can’t afford to buy houses through traditional means. But shared ownership can often significantly reduce the outlay both initially and on an ongoing basis for individuals across the country.

As well as population models and the risk and return dynamics, we look at where in the UK to invest. The proposition can be made that there’s an affordability crisis throughout the country, and an investment case can be made in every single area.

When we focus on local populations, what we don’t want to do is build houses that will then squeeze out the actual local population.

We want to provide good quality, fit for purpose, future proof housing which is suitable for the local population and the incomes that they derive from local jobs. Having that local mindset is the key to providing good quality affordable housing.

Finally, we look at how to implement this. Some investors may want to have a solely focused local strategy. In terms of fulfilling that local investment desire, there are additional fiduciary duties on investors who pursue that approach. We can facilitate local exposure via our

nationwide pooled fund; through a number of different partnerships we have with the major house builders. We employ a pooled fund to make sure that local is achieved, whilst ensuring wider fiduciary duties are met.

By pooling, you also get exposure to not only diversification from a traditional financial sense, but you can also contribute to solving for wider national problems, such as deprivation, which you may not be as acute within your individual local area.

Mike O’Donnell, non-executive director, independent: Let’s get everyone’s thoughts on what you’ve heard, and your own view and positioning with real estate.

Matthew Trebilcock, head of pensions, Gloucestershire Pension Fund: From a fund perspective, we’re looking at property in a multitude of different ways. We have our traditional property book, with diversification within the portfolio; standard UK property mandates looking across big balanced funds, but also some targeting within that, and international property as well.

What we’re hearing today is about the acute problem around residential housing in the UK. As a fund, we identify with that. We’ve made an allocation of 5% of our fund that is going to be targeted towards social and affordable housing. That’s on top of our 10% to traditional property. One of the reasons for that is the potential impact we can have. It does bring up challenges for us as a fund in terms of that fiduciary duty versus your impact, versus the localism, and the conflicts that those things bring. It’s interesting to hear about the dynamics of how we can

“If you’re looking at making the impact around climate change and decarbonisation, is it a question of building new and to good ratings, or is it taking the existing property stock and uprating it?”

Matthew Trebilcock, head of pensions, Gloucestershire Pension Fund

control that within the proposals rather than the pension fund just being seen as a way of propping up the local economy without the actual return that is needed from the investors on that particular side.

There are a range of problems: from care providing strategies to models of shared ownership and affordable housing. I put affordable housing into two different categories, with a big ‘a’ and a little ‘a’, and there’s a spectrum of where you can be on that.

It’s also looking at what can you do with localism. There may be more traction in our area in Gloucestershire around affordable housing rather than the care strategies if you’re looking for that local impact because of some of the issues that you face on that side.

If you’re looking at making the impact around climate change and decarbonisation, 90% of the properties that will be around in 2050 are already built. So is it a question of building new and to good ratings, or is it taking the existing property stock and uprating it? Is it more impactful to modernise the current stock and make it more energy efficient? Those are some of the dynamics that we’re working through as we’re looking at this sector.

Jo Thistlewood, pension fund manager, Isle of Wight Council: We haven’t allocated to property; our property is pools funds on commercials. We’ve been in that fund a long time and our total allocation is about 8% and at the moment we’re about 5%. That’s about £40m.

The council is addressing housing problems. It is reinstituting the Housing Revenue Account because it had outsourced all of its property, but is now looking at building more houses.

Jo Thistlewood,

pension fund manager,

Isle of Wight Council

“Within the pooled solution we could put allocations into different funds that are available to us to broaden our exposure to property.”

We, as a fund, are being asked if we can fund it. There are questions like what’s the risk? What’s the return? How are you going to make it work? Who’s going to be the landlord?

The fund hasn’t really considered social housing or residential as an asset class. But we are looking forward to working with CBRE IM to determine a solution, whatever that solution may be. It’s something that we will probably have to think about. But with the pension fund committee and the council, local has a very distinct border.

It is quite difficult to say we’re going to invest in local social housing, but it’s going to be in Norfolk or Cambridgeshire.

In terms of the pooling options, having only £35-40m to put into property makes it difficult for us to diversify our own portfolio, but within the pooled solution we could put allocations into different funds that are available to us to broaden our exposure to property.

James Sivyer, Vice President, Private Markets, Redington: We have a number of clients who are interested in the affordable housing space on the LGPS side. Some are at an early stage learning about the asset class, and others are more advanced. Broadly speaking, our LGPS clients see it in terms of mission alignment: what’s going on in their local area and the levelling up agenda.

A lot of funds we speak to are very keen on the local elements, so doing things like side cars or allocations within the main fund. While there are lots of appealing aspects to social affordable, on the local side in particular funds need to be cognisant of some of the risks involved – making sure they’re not concentrating their reputational financial risk and looking at the structures and the policies that managers have put in place.

This means making sure that they have things like proper allocation policies going in the side car and the main funds, while ensuring there aren’t conflicts of interest and the portfolio is not becoming skewed to one particular part of the country.

Broadly speaking, clients are looking to this as a new area where they might seek diversification within their portfolio. That’s a key appeal.

George Graham, director, South Yorkshire Pensions Authority

“We’re getting an income stream but the impact is being recycled. We get the money back so we can make another loan as opposed to just sitting on the rental stream.”

Christopher Osborne, senior portfolio manager private markets, London CIV: When we look at our property portfolio and our strategy going forward, in this volatile macro-economic environment, we’re focusing on sectors that are essential to society’s needs. Housing is up there.

We launched the UK Affordable Housing Fund in March this year. We see it as a long-term play. There is a huge supply/demand imbalance which we’re not going to solve even in 20 years. We’ve had good demand from our London boroughs. To date £200m has come through since March and we’ve got another £100m in the near term.

George Graham, director, South Yorkshire Pensions Authority: We’re quite committed to the idea of place-based impact. We accept that while we might want all that impact to be in South Yorkshire, it's not all going to be. There are good reasons from a management point of view too why we wouldn’t want that.

Within the core property portfolio we’ve got a number of traditional general needs housing, with the residential funds doing what they do. In the more active portfolio, we’ve got three pots that address real estate in one way or another. One is around specialist housing and another is local general needs. We’ve got a £25m allocation which was a side car to a previous local fund. That’s financed about 150 houses in a new urban village on the edge of Rotherham. That’s making a positive impact.

The third is a development lending pot which isn’t restricted to residential. We have financed apartments in the middle of Sheffield and 150 eco homes on a regeneration site, as well as other smaller schemes.

We’re getting an income stream but the impact is being recycled. We get the money back so we can make another loan as opposed to just sitting on the rental stream.

We’re not committed to doing anything. We’re quite careful to make sure that people who know what they are doing are evaluating proposals. That’s important because I’ve only got a team of four people managing all the fund’s investments. There’s a resource constraint and these things take much longer to bring to fruition.

Christopher Osborne, senior portfolio manager private markets, London CIV

“We like this sector because it tends to have less sensitivity to changes in the economy. It exhibits lower correlation with other real estate income investments.”

It’s predominately going to be an indirect strategy; we’re selecting managers to invest in the sector on our behalf. We’re targeting the regulated part of social and affordable housing. It’s a nationwide strategy for us. Although we have a London client base, we’re very upfront with them at the outset. We thought the best way to tackle this sector was to go nationwide. Investors will get priority where the investments are in their backyard.

We like this sector because it tends to have less sensitivity to changes in the economy. It exhibits lower correlation with other real estate income investments. Most importantly, it provides a platform to deliver long dated income and stable income which is the priority for our LGPS investor base. It’s often linked to and typically tracks inflation. It’s less influenced by market forces such as the pandemic. Affordable housing rent collection was really high compared to other sectors during the pandemic.

It comes back to that supply/demand imbalance. We see this as an excellent asset class for investors to balance their property exposure.

Mike O’Donnell: Place-based investment seems to be a common theme, any more thoughts on that?

James Sivyer: From a local perspective when you’re thinking about diversification, with the geographical exposure that many LGPS have in their funds already in terms of property, is more likely to be concentrated around the big cities like Manchester, London, and Birmingham. If you’re a rural county LGPS you’re less likely to have that kind of local exposure already, so local could be the thing that might give you a bit more diversification from a geographical perspective.

Catriona Buckley, senior director, client solutions, CBRE Investment Management

“It is a complex balance that everybody is grappling with, because the local needs are very different, regardless of where you’re looking.”

We need to go in depth around what we consider impacts. Looking at the juxtaposition between building new homes and repurposing, on balance our strategy is that to solve affordable housing issues, it’s better to build.

However, we do have assets within our portfolio where we have installed air source heat pumps and replaced oil boilers for instance.

Catriona Buckley, senior director, client solutions, CBRE Investment Management: It’s not a one-size-fits-all approach. When you’re interacting with LGPS schemes this is a topic that everybody is very happy to talk about at the moment.

It is a complex balance that everybody is grappling with, because the local needs are very different, regardless of where you’re looking. The pension committee may have strong views on where they want to allocate capital. There’s a lot of fine balancing. As providers of solutions, our role is to guide our investors as to what we think is a strong investment case for their particular situation.

Christopher Osborne: The 32 London boroughs would love to have social and affordable housing in their backyard. But if we’re going to deliver the most secure risk averse returns, we needed it to be a nationwide strategy. We are still cognisant of their needs and we’re looking at more creative ways, such as co-investments, to try and unlock those type of affordable housing deals in London. They bought into that ultimately, the returns are the most important thing. First and foremost, we’re about paying pensions. But impact is also very important, and local impact in London is important. We spend a lot of time understanding the intentions of managers when it comes to impact. We spend a lot of time looking at managers’ impact frameworks.

Andrew Davey: Clear communication is critical to all of this. When we’re engaging with investors and potential investors in the initial stages we need to really articulate what we’re capable of doing and what we’ve got conviction for, both in terms of how we approach local strategy as well as the wider fund strategy.

Ashley Manning-Brown, Head of UK Investor Solutions, Pluto Finance

“For local government schemes it’s about engaging with the providers of residential, whether debt or equity, and having that honest and open ongoing engagement.”

“For local government schemes it’s about engaging with the providers of residential… and having that honest and open ongoing engagement.”

We would only do that where the financials stack up. It’s being 100% clear around what we’re actually targeting from an impact perspective, and putting that on a level with what we’re targeting from a risk and return perspective.

We look at the tenures which we can access. We engage with our development partners and are proactive around sourcing that stock, but given certain characteristics of borrowers, certain tenures may not be achievable or appropriate in those areas. The time to invest may also take longer.

Matthew Trebilcock: I think that’s one of the challenges that we have as funds and as an investor. We can allocate 5% to local impact but it only has an impact when that fund is actually allocated. One challenge around localism is the speed of deployment of that within that region. That’s one of the trade-offs that decision makers need to take on board, about whether the speed of deployment is worth the impact. Or is it better to get that from a wider exposure? The potential goes a little bit wider. I think those are the kinds of things that we’re working through balancing, as well as the ability to recycle, as George mentioned.

Ashley Manning-Brown, head of UK investor solutions, Pluto Finance: I agree there’s no one-size-fits-all approach. There’s different ways of accessing residential: through debt or through equity. Is it at the UK level? Is it at the pool level? Is it at the local level? Each LGPS scheme has a different preference. It might be better to look for a co-invest opportunity, as and when it comes. At the pool level, it might be going into an overall scheme and we’ve got an ability within our approach to invest across the UK and dial up and down local exposure as and when it becomes available.

xxx

James Sivyer, vice president, private markets, Redington

“If it’s your aim to have news attaching your council’s name to the local investment you make, if something blows up with a fund that you’ve allocated to, then that’s a problem.”

That comes prime and centre because that, ultimately, is what we’re all here to do, as well as provide societal impacts and good quality risk adjusted returns for our investors.

Justin Faiz: If the risk/return works for you then the next step is, do you want something bespoke in a side car? That could be local impact, it could be a specific sort of impact, and it’s about working with your provider to deliver a bespoke equity or lending programme that meets your requirements in a way that’s realistic.

James Sivyer: Another point is scrutiny. This goes back to local because if it’s your aim to have a news article where you’re attaching your council’s name to the local investment you make, if something blows up with a fund that you’ve allocated to, then that’s a problem. Making sure there is proper scrutiny at the point of investment but also with ongoing monitoring is important.

There’s also a tension in impact on whether you’re delivering that impact just once. Additionality is another consideration.

Justin Faiz: It perhaps goes against the investment thesis of many people in this room, the idea that we probably all want to be long term investors and yet you make the most impact by delivering an asset, moving on, and doing it again.

George Graham: The income stream is what’s long term in debt finance. What we’re trying to do, in different ways, is find the best ways of making the return we needed to make. In Gloucestershire equity might be the way to go. In our part of the world, debt finance seems to work. It’s very much horses for courses.

Catriona Buckley: Is this an asset class that naturally fits with the pool, or does it naturally fit with the underlying funds themselves? It’s interesting because we’ve got different approaches within that.

Andrew Davey: In terms of final thoughts, I think it’s important when looking at a solution to engage with your manager and understand, as we’ve discussed, it’s not a one-size-fits-all. Really quiz your managers on the impact they’re looking to have. If you’re undertaking a local solution, make sure that it’s specific local needs that you’re addressing but also make sure that the fiduciary duty is always there.

2 The Good Economy

1 Place-based impact investing | Impact Investing Institute

“Investments made with the intention to yield appropriate risk-adjusted financial returns as well as positive local impact, with a focus on addressing the needs of specific places to enhance local economic resilience, prosperity and sustainable development.”

Defining place-based impact investing2

As with any real estate investment, understanding the local demographics of a town or region is critical to underwriting. In selecting appropriate investment opportunities within the residential sector, we consider the need for housing nationwide along with the specific financial and impact dynamics within each local submarket.

Aspirations for place-based investing have increasingly emerged in LGPS circles in recent years, as pension committees endeavour to marry up investment opportunities that can deliver attractive risk adjusted returns as well as delivering positive local impact. Directing private impact capital towards local objectives has been shown to be an effective way to raise living standards, provide economic opportunity, and build thriving, inclusive communities1.

Real estate is a well-established element of most LGPS portfolios, offering predictable income returns which generally provide a degree of inflation hedging. Diversifying traditional real estate allocations to include affordable housing is a natural progression that could help LGPS investors meet their dual objectives of fiduciary responsibility and creating positive impact.

A place-based approach to affordable housing is crucial to ensuring that we build the right type of housing, in the right places, explains Andrew Davey, head of affordable housing at CBRE Investment Management.

“There are 28 million households in the UK, of which 9.5 million currently rent their home. The ‘Regulated Rent’ sector which is also referred to as ‘Social Housing’ provides for 4.5 million households, with a further 1.3m households on waiting lists.”

Understanding nationwide needs

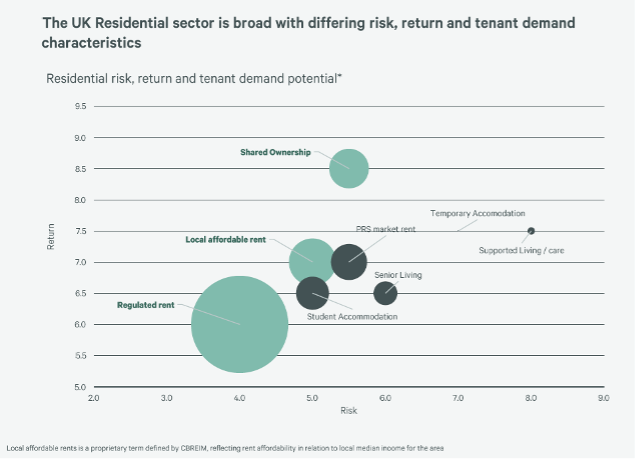

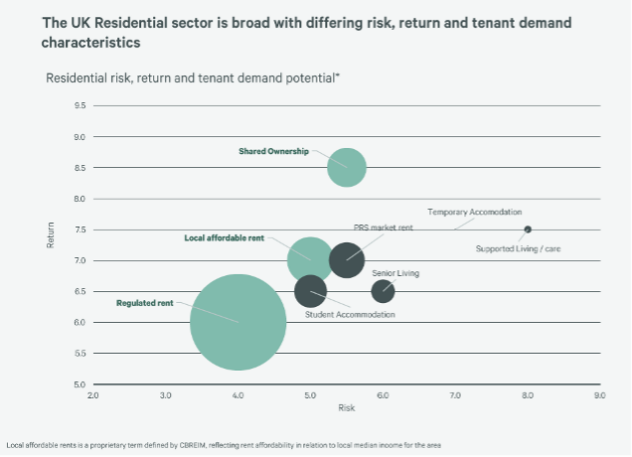

It is tempting to take a relatively broad view of UK residential investment opportunities, however the residential sector is highly nuanced, with wide variations in the types of housing needed by households and risk and return opportunities available to investors across the different housing tenures and models.

The scale of the investment opportunity within each housing tenure is a function of the underlying demand pool. A larger tenant or owner pool not only indicates greater occupier demand from a financial perspective but also greater potential impact from a social perspective. Mapping the UK residential universe can illustrate how an investor approaching the sector can begin to think about portfolio positioning.

Proprietary analysis from CBRE Investment Management (CBRE IM) shows that the bulk of tenant demand sits in the ‘Regulated Rent’ and ‘Local Affordable Rent’ segments. Indeed, these two combined comprise over half of the total rental pool across the UK.

There are 28 million households in the UK, of which 9.5 million currently rent their home. The ‘Regulated Rent’ sector which is also referred to as ‘Social Housing’ provides for 4.5 million households, with a further 1.3m households on waiting lists.

By comparison, with average market rent in the Private Rented Sector (PRS) now close to £1,300 per month, a household would need to earn £52,000 gross income a year for this to be affordable.

“Implementing a local, place-based strategy requires analysis that goes deeper into the specific needs of a defined local area. A simple copy and paste of a nationwide top-down strategy is unlikely to provide the optimal local balance between financial return and impact.”

As a result, 55% of renters in the UK cannot afford to rent at market rent levels. The demand pool for Regulated Rent and Local Affordable rented properties is likely to grow larger as incomes fail to keep up with rental growth in the PRS sector.

Understanding local needs

The analysis above identifies nationwide needs, however implementing a local, place-based strategy requires analysis that goes deeper into the specific needs of a defined local area. A simple copy and paste of a nationwide top-down strategy is unlikely to provide the optimal local balance between financial return and impact.

It may seem obvious, but targeting the specific needs of a local area is required to optimise both impact and financial performance. This can only be done by going back to basics by focusing on location, demographics and the provision of the correct product to match local consumer needs.

Recognising this, analysis can be conducted into specific local purchase and rental affordability characteristics as well as the nature of demand. As an example, a longer than average local waiting list may provide evidence that the most appropriate housing provision is via the implementation of regulated rented accommodation.

Once local needs have been identified, the method of implementation is pivotal to success. The execution of a local place-based investment strategy should always ensure that fiduciary duties are front of mind.

At CBRE IM, we believe that this is achieved by leveraging a robust, independent, governance process. On behalf of our LGPS investors, we have the ability to source local placed-based investment opportunities within our pooled affordable housing fund. By channelling place-based investments through an established pooled fund vehicle, investors can overlay the rigour of CBRE IM governance and investment process to ensure that financial integrity is maintained, gain exposure to an established and diversified portfolio of investments, and ensure any perception of political influence or conflicts of interests are removed.

Conclusions

Given the structural undersupply that has persisted for decades, there is no shortage of investment opportunities and the case for investment in affordable housing can be made across the United Kingdom. However, different locations have different acute needs. Only a locally focused approach can adequately meet these needs and ensure the appropriate financial and impact performance.

Implementing a place-based investment strategy can present issues for LGPS investors in the form of conflicts of interest or political objectives overriding fiduciary duties. To overcome these CBRE IM can source opportunities on behalf of LGPS investors to deliver place-based investments, whilst maintaining independent governance and maintenance of fiduciary duty, ensuring that a truly local approach leads to both local impact and attractive risk-adjusted returns for investors.

• decentralisation – moving the power from central to local government;

• localism – letting communities have more say in housing projects; and,

• the urban housing crisis – creating more affordable housing meeting the needs of local populations.

In response to the crisis, policymakers are attempting to tackle the problem through a variety of measures, including the construction of more affordable housing, regulations on landlords, and incentives for first-time buyers. Government responsibility for solving the housing crisis lies with the Department for Levelling Up, Housing and Communities (DLUHC), whose priorities focus on:

The United Kingdom is currently grappling with a severe housing crisis. This is a multifaceted issue that has far-reaching social, economic, and political implications. At its core, the crisis is marked by a chronic shortage of affordable, quality housing, which has created a myriad of problems for individuals and communities across the country.

There are serious societal consequences from the crisis that go way beyond the headlines of high property prices and unaffordable rents. Britain’s housing shortfall is changing the way we live, for the worse – forcing many to live in substandard or even unsafe accommodation or endure marathon daily commutes. The number of adult children living at home still has rocketed – with over a third of males aged 20-34 still living with their parents.

It is an intricate challenge that requires careful consideration, as it is intrinsically linked to issues of economic inequality, urban planning, and social welfare.

Private credit platforms can help address the UK’s housing shortfall as banks have retreated from residential development, says Pluto Finance. Here’s how.

building societies have provided the bulk of financing for residential development projects. However, since the GFC, the change in regulations covering banking capital requirements (the Basel III regulations) have made it much more onerous for banks to fund residential development.

Banks now need to allocate 5-7 times more capital for a development loan than a residential mortgage of the same size. The void created by the retreat of conventional bank lenders has created the space for private credit platforms to take market share.

However, addressing the housing crisis in the UK will require a comprehensive, long-term approach that balances the interests of homeowners, renters, and those in need of social housing. Housebuilding is expensive and the supply of money tight in the council coffers.

Can Local Government Pension Schemes help support their local communities in this space? The answer is yes, but not at the expense of their primary role – pension provision for their members. They are not and should not be held to ransom by central government to address issues such as the undersupply of social housing.

However, we believe there is a way to address this in a considered structural manner, providing stable, consistent returns to investors and benefitting local communities at the same time.

How can private real estate debt help?

340,0001 is the latest estimate as to the number of new homes required each year. Housing delivery in England collapsed after the global financial crisis (GFC) reaching a low of 118,000 new homes delivered in 2012. Numbers have gradually climbed, reaching a post-GFC peak of 220,000 in 2020, before Covid again caused numbers to fall. The recent gilts crisis will also have a negative effect with large housebuilders postponing the delivery of multiphase schemes in light of rising interest rates.

Clearly, huge investment is required. Historically, high street banks and

From a borrower’s perspective, there are clear advantages to turning to private credit. Private lenders offer more flexibility and personalised solutions, making it easier for borrowers to navigate complex issues such as planning laws and zoning regulations. This customised approach can be a game-changer for those seeking financing in the housing sector, where one size rarely fits all.

How can schemes access place-based investments? What returns

can they expect?

At Pluto Finance, we have structured our approach to allow investors to gain access to nationwide opportunities in real estate debt, with the ability to dial up or down regional exposure to meet their own requirements. We know that differing schemes and pools have differing wants and requirements when thinking about the local agenda. We can support them to deliver tangible local and environmental impact projects, without affecting the bottom line.

We are the leading provider of finance to SME developers in the UK, with deep origination networks across the country. With over £3bn lent since 2011, funding the delivery of over 10,000 homes, our approach is tried and tested, centred around rigorous credit expertise. We offer opportunities in only the most senior secured tranche of the capital stack, across build-to-rent, build-to-let and purpose-built student accommodation (PBSA).

With a best-in-class credit track record and target net returns in excess of 10% IRR, Pluto helps institutions access a granular portfolio of UK real estate debt opportunities at the same time as helping deliver much needed affordable housing. Please get in touch to discuss how we can help.

Tap to jump to the feature

Pluto: Empowering

local areas

with private real estate

debt

CBRE IM: The need for a place-based approach to affordable housing

Read the roundtable report

Against a backdrop of economic uncertainty, real estate – when structured correctly – can provide sustainable, risk adjusted returns that act as an inflationary hedge.

What opportunities exist in the living and wider property spaces? How can these strategies achieve place-based impact? And what are the challenges and ways for the LGPS to invest in this asset class?

This roundtable explored where participants are currently with real estate, and found that while there are plenty of opportunities, there are no one-size-fits-all solutions and instead a variety of different paths to success in this ‘massive’ asset class.

Catriona Buckley, senior director, client solutions, CBRE Investment Management

Andrew Davey, head of liability aware strategies & affordable housing, CBRE Investment Management

Justin Faiz, co-founder & partner, Pluto Finance

George Graham, director, South Yorkshire Pensions Authority

Jason Holland, editor, Room151

Ashley Manning-Brown, head of UK investor solutions, Pluto Finance

Mike O’Donnell, non-executive director, independent (Chair)

Christopher Osborne, senior portfolio manager private markets, London CIV

James Sivyer, vice president, private

markets, Redington

Jo Thistlewood, pension fund manager,

Isle of Wight Council

Matthew Trebilcock, head of pensions, Gloucestershire Pension Fund

Real estate investing

for the LGPS Roundtable

The housing crisis means headlines of high prices and rents. But it is also a societal effect that impacts people’s quality of life. People are living in substandard housing that’s often unsafe or unsanitary. Others are tolerating a commute that takes a chunk out of their work/life balance. Young adults are living with their parents later in life.

If you accumulate the total shortfall since around 2012, we’ve under delivered about 500,000 units.

So even if the industry heroically manages to deliver again, it’s not going to scratch the surface of the cumulative shortfall. And this applies throughout the UK.

We can’t do anything about many of the reasons for the shortfall, but one thing we can change is that there is a systematic lack of availability for financing for house builders.

Justin Faiz,

co-founder & partner, Pluto Finance

“Specialising in residential is massive – it is not a niche asset class. But we also don’t have enough of it. That’s an interesting conundrum.”

Justin Faiz, co-founder & partner, Pluto Finance: We are a UK-only real estate private credit platform, and we’ve been doing it since 2011. We’ve funded the delivery of about 10,000 houses throughout the country in residential construction projects. The average value of one of our properties is £300k. We think that’s affordable, with a lowercase ‘a’, to real local owner occupiers and local renters, and it’s the kind of housing the UK is tremendously short of.

Residential property is today worth about £8tn – about eight times the size of corporate commercial and commercial real estate and more than the sum of total market cap plus issuance of corporate bonds and gilts.

It is not a niche asset class; specialising in residential is massive. But we also don’t have enough of it. That’s an interesting conundrum. We are in the middle of a housing crisis that successive governments of any flavour have failed to fix, and it only gets worse.

The current government needs to deliver about 300,000 units a year. At its pre-Covid peak, 220,000 units were delivered a year, so that’s still an 80,000 shortfall. Because of Covid, and with the gilts crisis and the volatility in interest rates, we are going to see a decline.

Mike O'Donnell chaired the roundtable

We like residential because there’s multiple exit options: you can build a scheme, you can lease it, you can refinance, or you can sell it to an institutional investor. That positions it well versus other asset classes with singular exits.

The other advantage, especially construction funding, is that the debt self regulates. At the end of two or three years the loan naturally repays.

Funding house builders is also inherently strong for ESG. Not only is the delivery of this affordable housing stock great for UK society, most of the funding can be on brownfield sites. We’ve chosen to do 95% of our funding on brownfield. It’s great for urban regeneration and for preserving green spaces.

Andrew Davey, head of liability aware strategies & affordable housing, CBRE Investment Management: The current UK affordability and residential crisis comes down to both demand and supply. There’s the more acute side to demand, with population rising, but the type of demographics is also changing. Households are becoming more disparate and there's more separation around what the target demographics in specific areas across the nation are actually looking for.

The supply side is also multi-layered. It’s not just the number of homes that are available, but also the suitability of housing. A small portion of the whole residential market is acceptable residential housing.

If you’re a high street bank and you want to lend to fund a house builder, for a loan of any size, you need seven times as much tier one or tier two capital compared to a residential mortgage of the same size, and the returns are not seven times greater. So guess where banks want to lend? House builders and particularly SME developers have been starved for financing. We can do something to correct this.

There are a number of ways to access residential in the UK. We specialise on the equity side, and when we fund house builders, we’re funding at about 65% loan to value so that means there’s a 35% headroom for the property prices, which is well sized to withstand any large property price correction. Borrowers are paying for that whole loan, and the margin is about 5-5.5%.

We want to narrow down into the local characteristics. Typically, we target the lowest 40% of deprived areas within the UK. However, that doesn't mean to say that an affluent area wouldn't be a focus for our investment because by definition it would be unaffordable to a number of the people living there. An affluent area may mean those longer waiting lists because people can’t gain access to the actual rental stock in those areas. But it also may mean that affordable ownership isn’t open to a number of the local population.

“We want to provide good quality, fit for purpose, future proof housing which is suitable for the local population and the incomes that they derive from local jobs.”

Andrew Davey, head of liability aware strategies & affordable housing, CBRE Investment Management

We haven’t got enough supply, and we probably haven’t got enough of the right supply. For us, that means building more houses and more of the right houses, led in an institutional framework making sure that we can influence what we are building.

At CBRE IM we’ve narrowed down into what we think is the most advantageous sub sector in residential, affordable housing. That’s where we can execute, and investors can achieve their financial, societal and wider impact goals. When we speak about affordable there are multiple layers within that. We typically target based upon regulated rent, which is basically benefit recipients.

We also target what we call the ‘squeezed middle’ in our other affordable bucket. We recognise that within London, 65%+ of an individual’s take home pay is made up of property costs or rent. That’s far too much, especially in the context of a cost-of-living crisis. We’re passionate about bringing that to a level which is sustainable going forward. Within London, for instance, we’re focusing on bringing that down to around 35 to 40% of an individual’s pay.

We recognise that renting isn’t the only equity solution in terms of investment. We provide an affordable ownership proposition recognising that a number of different people can’t afford to buy houses through traditional means. But shared ownership can often significantly reduce the outlay both initially and on an ongoing basis for individuals across the country.

As well as population models and the risk and return dynamics, we look at where in the UK to invest. The proposition can be made that there’s an affordability crisis throughout the country, and an investment case can be made in every single area.

By pooling, you also get exposure to not only diversification from a traditional financial sense, but you can also contribute to solving for wider national problems, such as deprivation, which you may not be as acute within your individual local area.

Mike O’Donnell, non-executive director, independent: Let’s get everyone’s thoughts on what you’ve heard, and your own view and positioning with real estate.

Matthew Trebilcock, head of pensions, Gloucestershire Pension Fund: From a fund perspective, we’re looking at property in a multitude of different ways. We have our traditional property book, with diversification within the portfolio; standard UK property mandates looking across big balanced funds, but also some targeting within that, and international property as well.

What we’re hearing today is about the acute problem around residential housing in the UK. As a fund, we identify with that. We’ve made an allocation of 5% of our fund that is going to be targeted towards social and affordable housing. That’s on top of our 10% to traditional property. One of the reasons for that is the potential impact we can have. It does bring up challenges for us as a fund in terms of that fiduciary duty versus your impact, versus the localism, and the conflicts that those things bring. It’s interesting to hear about the dynamics of how we can control that within the proposals rather than the pension fund just being seen as a way of propping up the local economy without the actual return that is needed from the investors on that particular side.

When we focus on local populations, what we don’t want to do is build houses that will then squeeze out the actual local population.

We want to provide good quality, fit for purpose, future proof housing which is suitable for the local population and the incomes that they derive from local jobs. Having that local mindset is the key to providing good quality affordable housing.

Finally, we look at how to implement this. Some investors may want to have a solely focused local strategy. In terms of fulfilling that local investment desire, there are additional fiduciary duties on investors who pursue that approach. We can facilitate local exposure via our nationwide pooled fund; through a number of different partnerships we have with the major house builders. We employ a pooled fund to make sure that local is achieved, whilst ensuring wider fiduciary duties are met.

“If you’re looking at making the impact around climate change and decarbonisation, is it a question of building new and to good ratings, or is it taking the existing property stock and uprating it?”

Matthew Trebilcock, head of pensions, Gloucestershire Pension Fund

There are a range of problems: from care providing strategies to models of shared ownership and affordable housing. I put affordable housing into two different categories, with a big ‘a’ and a little ‘a’, and there’s a spectrum of where you can be on that.

It’s also looking at what can you do with localism. There may be more traction in our area in Gloucestershire around affordable housing rather than the care strategies if you’re looking for that local impact because of some of the issues that you face on that side.

If you’re looking at making the impact around climate change and decarbonisation, 90% of the properties that will be around in 2050 are already built. So is it a question of building new and to good ratings, or is it taking the existing property stock and uprating it? Is it more impactful to modernise the current stock and make it more energy efficient? Those are some of the dynamics that we’re working through as we’re looking at this sector.

Jo Thistlewood, pension fund manager, Isle of Wight Council: We haven’t allocated to property; our property is pools funds on commercials. We’ve been in that fund a long time and our total allocation is about 8% and at the moment we’re about 5%. That’s about £40m.

The council is addressing housing problems. It is reinstituting the Housing Revenue Account because it had outsourced all of its property, but is now looking at building more houses.

It is quite difficult to say we’re going to invest in local social housing, but it’s going to be in Norfolk or Cambridgeshire.

In terms of the pooling options, having only £35-40m to put into property makes it difficult for us to diversify our own portfolio, but within the pooled solution we could put allocations into different funds that are available to us to broaden our exposure to property.

James Sivyer, Vice President, Private Markets, Redington: We have a number of clients who are interested in the affordable housing space on the LGPS side. Some are at an early stage learning about the asset class, and others are more advanced. Broadly speaking, our LGPS clients see it in terms of mission alignment: what’s going on in their local area and the levelling up agenda.

A lot of funds we speak to are very keen on the local elements, so doing things like side cars or allocations within the main fund. While there are lots of appealing aspects to social affordable, on the local side in particular funds need to be cognisant of some of the risks involved – making sure they’re not concentrating their reputational financial risk and looking at the structures and the policies that managers have put in place.

This means making sure that they have things like proper allocation policies going in the side car and the main funds, while ensuring there aren’t conflicts of interest and the portfolio is not becoming skewed to one particular part of the country.

Broadly speaking, clients are looking to this as a new area where they might seek diversification within their portfolio. That’s a key appeal.

Jo Thistlewood,

pension fund manager,

Isle of Wight Council

“Within the pooled solution we could put allocations into different funds that are available to us to broaden our exposure to property.”

We, as a fund, are being asked if we can fund it. There are questions like what’s the risk? What’s the return? How are you going to make it work? Who’s going to be the landlord?

The fund hasn’t really considered social housing or residential as an asset class. But we are looking forward to working with CBRE IM to determine a solution, whatever that solution may be. It’s something that we will probably have to think about. But with the pension fund committee and the council, local has a very distinct border.

“We’re getting an income stream but the impact is being recycled. We get the money back so we can make another

loan as opposed

to just sitting

on the rental

stream.”

George Graham, director, South Yorkshire Pensions Authority

Christopher Osborne, senior portfolio manager private markets, London CIV: When we look at our property portfolio and our strategy going forward, in this volatile macro-economic environment, we’re focusing on sectors that are essential to society’s needs. Housing is up there.

We launched the UK Affordable Housing Fund in March this year. We see it as a long-term play. There is a huge supply/demand imbalance which we’re not going to solve even in 20 years. We’ve had good demand from our London boroughs. To date £200m has come through since March and we’ve got another £100m in the near term.

George Graham, director, South Yorkshire Pensions Authority: We’re quite committed to the idea of place-based impact. We accept that while we might want all that impact to be in South Yorkshire, it's not all going to be. There are good reasons from a management point of view too why we wouldn’t want that.

Within the core property portfolio we’ve got a number of traditional general needs housing, with the residential funds doing what they do. In the more active portfolio, we’ve got three pots that address real estate in one way or another. One is around specialist housing and another is local general needs. We’ve got a £25m allocation which was a side car to a previous local fund. That’s financed about 150 houses in a new urban village on the edge of Rotherham. That’s making a positive impact.

The third is a development lending pot which isn’t restricted to residential. We have financed apartments in the middle of Sheffield and 150 eco homes on a regeneration site, as well as other smaller schemes.

We’re getting an income stream but the impact is being recycled. We get the money back so we can make another loan as opposed to just sitting on the rental stream.

We’re not committed to doing anything. We’re quite careful to make sure that people who know what they are doing are evaluating proposals. That’s important because I’ve only got a team of four people managing all the fund’s investments. There’s a resource constraint and these things take much longer to bring to fruition.

It’s predominately going to be an indirect strategy; we’re selecting managers to invest in the sector on our behalf. We’re targeting the regulated part of social and affordable housing. It’s a nationwide strategy for us. Although we have a London client base, we’re very upfront with them at the outset. We thought the best way to tackle this sector was to go nationwide. Investors will get priority where the investments are in their backyard.

We like this sector because it tends to have less sensitivity to changes in the economy. It exhibits lower correlation with other real estate income investments. Most importantly, it provides a platform to deliver long dated income and stable income which is the priority for our LGPS investor base. It’s often linked to and typically tracks inflation. It’s less influenced by market forces such as the pandemic. Affordable housing rent collection was really high compared to other sectors during the pandemic.

It comes back to that supply/demand imbalance. We see this as an excellent asset class for investors to balance their property exposure.

Mike O’Donnell: Place-based investment seems to be a common theme, any more thoughts on that?

James Sivyer: From a local perspective when you’re thinking about diversification, with the geographical exposure that many LGPS have in their funds already in terms of property, is more likely to be concentrated around the big cities like Manchester, London, and Birmingham. If you’re a rural county LGPS you’re less likely to have that kind of local exposure already, so local could be the thing that might give you a bit more diversification from a geographical perspective.

Christopher Osborne, senior portfolio manager private markets, London CIV

“We like this sector because it tends to have less sensitivity to changes in the economy. It exhibits lower correlation with other real estate income investments.”

Christopher Osborne: The 32 London boroughs would love to have social and affordable housing in their backyard. But if we’re going to deliver the most secure risk averse returns, we needed it to be a nationwide strategy. We are still cognisant of their needs and we’re looking at more creative ways, such as co-investments, to try and unlock those type of affordable housing deals in London. They bought into that ultimately, the returns are the most important thing. First and foremost, we’re about paying pensions. But impact is also very important, and local impact in London is important. We spend a lot of time understanding the intentions of managers when it comes to impact. We spend a lot of time looking at managers’ impact frameworks.

Andrew Davey: Clear communication is critical to all of this. When we’re engaging with investors and potential investors in the initial stages we need to really articulate what we’re capable of doing and what we’ve got conviction for, both in terms of how we approach local strategy as well as the wider fund strategy.

We need to go in depth around what we consider impacts. Looking at the juxtaposition between building new homes and repurposing, on balance our strategy is that to solve affordable housing issues, it’s better to build.

However, we do have assets within our portfolio where we have installed air source heat pumps and replaced oil boilers for instance.

Catriona Buckley, senior director, client solutions, CBRE Investment Management

“It is a complex balance that everybody is grappling with, because the local needs are very different, regardless of where you’re looking.”

Catriona Buckley, senior director, client solutions, CBRE Investment Management: It’s not a one-size-fits-all approach. When you’re interacting with LGPS schemes this is a topic that everybody is very happy to talk about at the moment.

It is a complex balance that everybody is grappling with, because the local needs are very different, regardless of where you’re looking. The pension committee may have strong views on where they want to allocate capital. There’s a lot of fine balancing. As providers of solutions, our role is to guide our investors as to what we think is a strong investment case for their particular situation.

Ashley Manning-Brown, head of UK investor solutions, Pluto Finance: I agree there’s no one-size-fits-all approach. There’s different ways of accessing residential: through debt or through equity. Is it at the UK level? Is it at the pool level? Is it at the local level? Each LGPS scheme has a different preference. It might be better to look for a co-invest opportunity, as and when it comes. At the pool level, it might be going into an overall scheme and we’ve got an ability within our approach to invest across the UK and dial up and down local exposure as and when it becomes available.

For local government schemes it’s about engaging with the providers of residential, whether debt or equity, having that honest and open ongoing engagement about when we can put the money to work and how it can work for you.

Ashley Manning-Brown, Head of UK Investor Solutions, Pluto Finance

“For local government schemes it’s about engaging with the providers of residential… and having that honest and open ongoing engagement.”

We would only do that where the financials stack up. It’s being 100% clear around what we’re actually targeting from an impact perspective, and putting that on a level with what we’re targeting from a risk and return perspective.

We look at the tenures which we can access. We engage with our development partners and are proactive around sourcing that stock, but given certain characteristics of borrowers, certain tenures may not be achievable or appropriate in those areas. The time to invest may also take longer.

Matthew Trebilcock: I think that’s one of the challenges that we have as funds and as an investor. We can allocate 5% to local impact but it only has an impact when that fund is actually allocated. One challenge around localism is the speed of deployment of that within that region. That’s one of the trade-offs that decision makers need to take on board, about whether the speed of deployment is worth the impact. Or is it better to get that from a wider exposure? The potential goes a little bit wider. I think those are the kinds of things that we’re working through balancing, as well as the ability to recycle, as George mentioned.

George Graham: The income stream is what’s long term in debt finance. What we’re trying to do, in different ways, is find the best ways of making the return we needed to make. In Gloucestershire equity might be the way to go. In our part of the world, debt finance seems to work. It’s very much horses for courses.

Catriona Buckley: Is this an asset class that naturally fits with the pool, or does it naturally fit with the underlying funds themselves? It’s interesting because we’ve got different approaches within that.

Andrew Davey: In terms of final thoughts, I think it’s important when looking at a solution to engage with your manager and understand, as we’ve discussed, it’s not a one-size-fits-all. Really quiz your managers on the impact they’re looking to have. If you’re undertaking a local solution, make sure that it’s specific local needs that you’re addressing but also make sure that the fiduciary duty is always there.

That comes prime and centre because that, ultimately, is what we’re all here to do, as well as provide societal impacts and good quality risk adjusted returns for our investors.

Justin Faiz: If the risk/return works for you then the next step is, do you want something bespoke in a side car? That could be local impact, it could be a specific sort of impact, and it’s about working with your provider to deliver a bespoke equity or lending programme that meets your requirements in a way that’s realistic.

James Sivyer, vice president, private markets, Redington

“If it’s your aim to have news attaching your council’s name to the local investment you make, if something blows up

with a fund that

you’ve allocated

to, then that’s a

problem.”

James Sivyer: Another point is scrutiny. This goes back to local because if it’s your aim to have a news article where you’re attaching your council’s name to the local investment you make, if something blows up with a fund that you’ve allocated to, then that’s a problem. Making sure there is proper scrutiny at the point of investment but also with ongoing monitoring is important.

There’s also a tension in impact on whether you’re delivering that impact just once. Additionality is another consideration.

Justin Faiz: It perhaps goes against the investment thesis of many people in this room, the idea that we probably all want to be long term investors and yet you make the most impact by delivering an asset, moving on, and doing it again.

Understanding nationwide needs

It is tempting to take a relatively broad view of UK residential investment opportunities, however the residential sector is highly nuanced, with wide variations in the types of housing needed by households and risk and return opportunities available to investors across the different housing tenures and models.

The scale of the investment opportunity within each housing tenure is a function of the underlying demand pool. A larger tenant or owner pool not only indicates greater occupier demand from a financial perspective but also greater potential impact from a social perspective. Mapping the UK residential universe can illustrate how an investor approaching the sector can begin to think about portfolio positioning.

“Investments made with the intention to yield appropriate risk-adjusted financial returns as well as positive local impact, with a focus on addressing the needs of specific places to enhance local economic resilience, prosperity and sustainable development.”

Defining place-based impact investing2

Aspirations for place-based investing have increasingly emerged in LGPS circles in recent years, as pension committees endeavour to marry up investment opportunities that can deliver attractive risk adjusted returns as well as delivering positive local impact. Directing private impact capital towards local objectives has been shown to be an effective way to raise living standards, provide economic opportunity, and build thriving, inclusive communities1.

Real estate is a well-established element of most LGPS portfolios, offering predictable income returns which generally provide a degree of inflation hedging. Diversifying traditional real estate allocations to include affordable housing is a natural progression that could help LGPS investors meet their dual objectives of fiduciary responsibility and creating positive impact.

As with any real estate investment, understanding the local demographics of a town or region is critical to underwriting. In selecting appropriate investment opportunities within the residential sector, we consider the need for housing nationwide along with the specific financial and impact dynamics within each local submarket.

A place-based approach to affordable housing is crucial to ensuring that we build the right type of housing, in the right places, explains Andrew Davey, head of affordable housing at CBRE Investment Management.

“There are 28 million households in the UK, of which 9.5 million currently rent their home. The ‘Regulated Rent’ sector which is also referred to as ‘Social Housing’ provides for 4.5 million households, with a further 1.3m households on waiting lists.”

Proprietary analysis from CBRE Investment Management (CBRE IM) shows that the bulk of tenant demand sits in the ‘Regulated Rent’ and ‘Local Affordable Rent’ segments. Indeed, these two combined comprise over half of the total rental pool across the UK.

There are 28 million households in the UK, of which 9.5 million currently rent their home. The ‘Regulated Rent’ sector which is also referred to as ‘Social Housing’ provides for 4.5 million households, with a further 1.3m households on waiting lists.

By comparison, with average market rent in the Private Rented Sector (PRS) now close to £1,300 per month, a household would need to earn £52,000 gross income a year for this to be affordable.

At CBRE IM, we believe that this is achieved by leveraging a robust, independent, governance process. On behalf of our LGPS investors, we have the ability to source local placed-based investment opportunities within our pooled affordable housing fund. By channelling place-based investments through an established pooled fund vehicle, investors can overlay the rigour of CBRE IM governance and investment process to ensure that financial integrity is maintained, gain exposure to an established and diversified portfolio of investments, and ensure any perception of political influence or conflicts of interests are removed.

Conclusions

Given the structural undersupply that has persisted for decades, there is no shortage of investment opportunities and the case for investment in affordable housing can be made across the United Kingdom. However, different locations have different acute needs. Only a locally focused approach can adequately meet these needs and ensure the appropriate financial and impact performance.

Implementing a place-based investment strategy can present issues for LGPS investors in the form of conflicts of interest or political objectives overriding fiduciary duties. To overcome these CBRE IM can source opportunities on behalf of LGPS investors to deliver place-based investments, whilst maintaining independent governance and maintenance of fiduciary duty, ensuring that a truly local approach leads to both local impact and attractive risk-adjusted returns for investors.

As a result, 55% of renters in the UK cannot afford to rent at market rent levels. The demand pool for Regulated Rent and Local Affordable rented properties is likely to grow larger as incomes fail to keep up with rental growth in the PRS sector.

Understanding local needs

The analysis above identifies nationwide needs, however implementing a local, place-based strategy requires analysis that goes deeper into the specific needs of a defined local area. A simple copy and paste of a nationwide top-down strategy is unlikely to provide the optimal local balance between financial return and impact.

It may seem obvious, but targeting the specific needs of a local area is required to optimise both impact and financial performance. This can only be done by going back to basics by focusing on location, demographics and the provision of the correct product to match local consumer needs.

Recognising this, analysis can be conducted into specific local purchase and rental affordability characteristics as well as the nature of demand. As an example, a longer than average local waiting list may provide evidence that the most appropriate housing provision is via the implementation of regulated rented accommodation.

Once local needs have been identified, the method of implementation is pivotal to success. The execution of a local place-based investment strategy should always ensure that fiduciary duties are front of mind.

Private credit platforms can help address the UK’s housing shortfall as banks have retreated from residential development, says Pluto Finance. Here’s how.

• decentralisation – moving the power from central to local government;

• localism – letting communities have more say in housing projects; and,

• the urban housing crisis – creating more affordable housing meeting the needs of local populations.

The United Kingdom is currently grappling with a severe housing crisis. This is a multifaceted issue that has far-reaching social, economic, and political implications. At its core, the crisis is marked by a chronic shortage of affordable, quality housing, which has created a myriad of problems for individuals and communities across the country.

There are serious societal consequences from the crisis that go way beyond the headlines of high property prices and unaffordable rents. Britain’s housing shortfall is changing the way we live, for the worse – forcing many to live in substandard or even unsafe accommodation or endure marathon daily commutes. The number of adult children living at home still has rocketed – with over a third of males aged 20-34 still living with their parents.

It is an intricate challenge that requires careful consideration, as it is intrinsically linked to issues of economic inequality, urban planning, and social welfare.

In response to the crisis, policymakers are attempting to tackle the problem through a variety of measures, including the construction of more affordable housing, regulations on landlords, and incentives for first-time buyers. Government responsibility for solving the housing crisis lies with the Department for Levelling Up, Housing and Communities (DLUHC), whose priorities focus on:

However, we believe there is a way to address this in a considered structural manner, providing stable, consistent returns to investors and benefitting local communities at the same time.

How can private real estate debt help?

340,0001 is the latest estimate as to the number of new homes required each year. Housing delivery in England collapsed after the global financial crisis (GFC) reaching a low of 118,000 new homes delivered in 2012. Numbers have gradually climbed, reaching a post-GFC peak of 220,000 in 2020, before Covid again caused numbers to fall. The recent gilts crisis will also have a negative effect with large housebuilders postponing the delivery of multiphase schemes in light of rising interest rates.

Clearly, huge investment is required. Historically, high street banks and building societies have provided the bulk of financing for residential development projects. However, since the GFC, the change in regulations covering banking capital requirements (the Basel III regulations) have made it much more onerous for banks to fund residential development.

Banks now need to allocate 5-7 times more capital for a development loan than a residential mortgage of the same size. The void created by the retreat of conventional bank lenders has created the space for private credit platforms to take market share.

From a borrower’s perspective, there are clear advantages to turning to private credit. Private lenders offer more flexibility and personalised solutions, making it easier for borrowers to navigate complex issues such as planning laws and zoning regulations. This customised approach can be a game-changer for those seeking financing in the housing sector, where one size rarely fits all.

How can schemes access place-based investments? What returns can they expect?

At Pluto Finance, we have structured our approach to allow investors to gain access to nationwide opportunities in real estate debt, with the ability to dial up or down regional exposure to meet their own requirements. We know that differing schemes and pools have differing wants and requirements when thinking about the local agenda. We can support them to deliver tangible local and environmental impact projects, without affecting the bottom line.

We are the leading provider of finance to SME developers in the UK, with deep origination networks across the country. With over £3bn lent since 2011, funding the delivery of over 10,000 homes, our approach is tried and tested, centred around rigorous credit expertise. We offer opportunities in only the most senior secured tranche of the capital stack, across build-to-rent, build-to-let and purpose-built student accommodation (PBSA).

With a best-in-class credit track record and target net returns in excess of 10% IRR, Pluto helps institutions access a granular portfolio of UK real estate debt opportunities at the same time as helping deliver much needed affordable housing. Please get in touch to discuss how we can help.

However, addressing the housing crisis in the UK will require a comprehensive, long-term approach that balances the interests of homeowners, renters, and those in need of social housing. Housebuilding is expensive and the supply of money tight in the council coffers.

Can Local Government Pension Schemes help support their local communities in this space? The answer is yes, but not at the expense of their primary role – pension provision for their members. They are not and should not be held to ransom by central government to address issues such as the undersupply of social housing.